Discovering Installment Loans: How They Work and What You Required to Know

Installment loans are a common monetary device that many people and family members utilize to satisfy numerous needs. These loans feature organized repayment plans, enabling consumers to repay the finance amount in time with taken care of month-to-month payments. Comprehending the various kinds and mechanics of installment loans is important. Nonetheless, possible borrowers ought to likewise know the advantages and threats entailed. What factors should one consider before committing to an installment car loan?

What Are Installment Loans?

Numerous kinds of loaning exist, installment loans stand out due to their organized repayment plans. These loans are characterized by a fixed amount obtained, which is settled over a specific duration with routine repayments. Each installment commonly includes both principal and interest, permitting consumers to progressively minimize their financial obligation. This predictability makes installment loans attracting individuals seeking to handle their funds successfully.

Debtors typically utilize installment loans for significant expenditures, such as buying a cars and truck, financing home remodellings, or consolidating financial debt. Unlike revolving debt alternatives, such as credit cards, installment loans give a clear timeline for payment, reducing economic uncertainty. With various lending institutions providing competitive terms, consumers can typically select loans customized to their needs. On the whole, installment loans act as a practical funding option, making it possible for people to gain access to required funds while maintaining a convenient payment timetable.

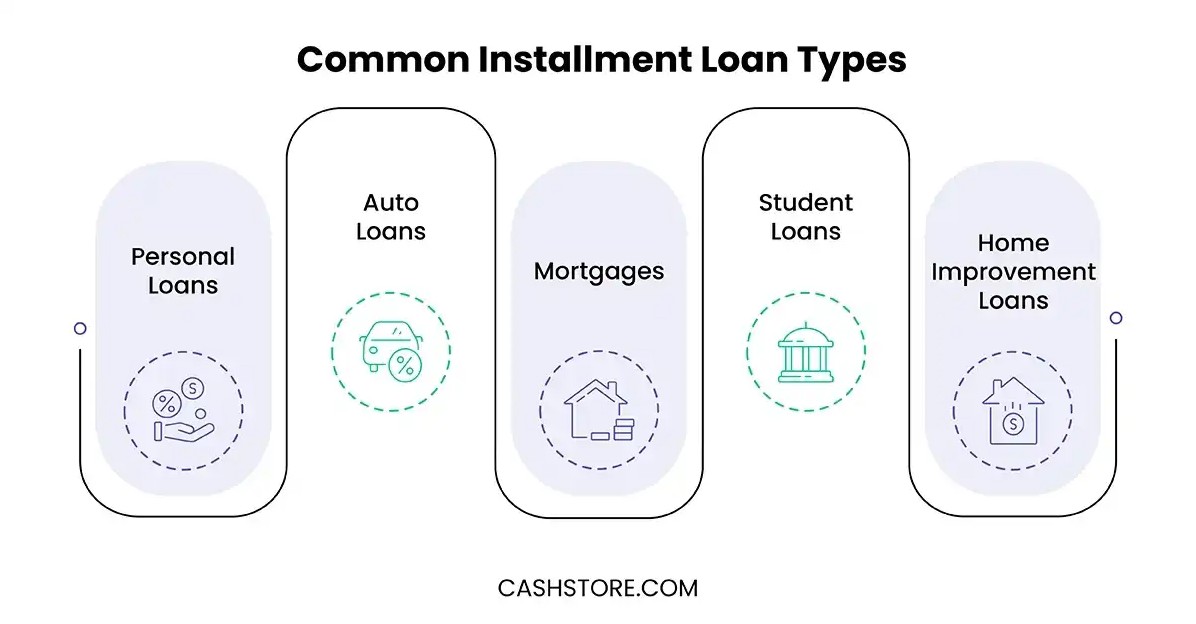

Sorts Of Installment Loans

Individual Installment Loans

Personal installment loans represent an adaptable monetary service for individuals looking for to handle larger expenditures. These loans give debtors with a round figure of cash that is paid back over a collection duration through fixed month-to-month repayments. They can be used for numerous functions, including home renovations, medical costs, or financial obligation consolidation. Unlike charge card, individual installment loans normally provide reduced rate of interest rates, making them a much more economical selection for significant acquisitions. Approval usually needs a credit history check and assessment of earnings, ensuring that lending institutions can gauge the consumer's ability to pay off. In general, individual installment loans serve as an obtainable option for those requiring organized payment strategies while managing their monetary demands effectively.

Automobile Loans

Auto loans are a prominent sort of installment lending created especially for purchasing automobiles. These loans permit customers to finance the price of a vehicle, with the expectation of settling the major amount together with rate of interest over a fixed period, generally varying from 3 to 7 years. Lenders analyze borrowers' debt-to-income, earnings, and credit reliability proportion to establish loan eligibility and rate of interest. Month-to-month payments are fixed, making budgeting simpler for customers. Car loans can be protected or unprotected, with safe loans requiring the vehicle as collateral, possibly causing reduced passion prices. It is crucial for consumers to search for the finest terms and think about elements such as car loan duration, total passion paid, and any kind of charges connected with the car loan.

Home Equity Loans

Home equity loans, a popular option amongst house owners, allow people to obtain against the equity they have integrated in their properties. These loans typically give a swelling sum of cash, which is then repaid over a set term with routine monthly settlements. The amount obtained is frequently identified by the property's evaluated worth and the homeowner's continuing to be home mortgage balance. They generally provide reduced interest prices compared to unprotected loans because home equity loans are protected by the property. Nevertheless, borrowers need to recognize the risks entailed, including the capacity for repossession if they fail to make repayments. Overall, home equity loans can be a beneficial economic tool for funding home enhancements, settling debt, or covering unforeseen expenditures.

How Installment Loans Job

Recognizing how installment loans work begins with examining their framework, which commonly includes a principal amount and collection rates of interest. Borrowers agree to pay back the funding in dealt with monthly installments over a predetermined period. This repayment process enables predictable budgeting, making it simpler for consumers to handle their funds.

Lending Structure Discussed

Installment loans are structured financial products that allow borrowers to receive a round figure of cash ahead of time and settle it over a given period with regular, fixed payments - Payday Loans. Generally, these loans have a predetermined term, ranging from a couple of months to numerous years, depending upon the loan provider and the customer's demands. The financing quantity, rates of interest, and repayment term are developed at the start, producing a clear framework for repayment. Rate of interest may be fixed or variable, affecting general costs. Borrowers often pick installment loans for considerable purchases like lorries or home enhancements, as the predictable settlement routine helps with budgeting. Understanding the framework of these loans is important for making educated loaning decisions and taking care of monetary obligations successfully

Repayment Process Summary

The payment process of installment loans is a methodical technique that permits consumers to handle their economic commitments properly. Borrowers generally pay back the car loan in equal regular monthly installments over a predetermined period, referred to as the finance term. Each installment consists of both major and passion, ensuring the car loan is gradually paid off. The rates of interest, affected by credit reliability and market problems, establishes the total price of loaning. Prompt repayments are necessary, as late settlements might sustain charges and negatively impact credit rating scores. Many lenders offer hassle-free settlement approaches, consisting of online systems and automated withdrawals. Recognizing the settlement structure aids borrowers in budgeting and maintaining economic stability throughout the life of the lending.

Advantages of Utilizing Installment Loans

One of the significant advantages of utilizing installment loans is the organized repayment strategy they offer. Consumers can gain from predictable monthly repayments, which simplify budgeting and monetary preparation. This consistency help individuals in handling their financial resources without the stress of changing repayment quantities.

Furthermore, installment loans often include reduced rate of interest prices compared to credit rating cards, making them an extra cost-effective choice for unanticipated expenditures or large purchases. Numerous lending institutions additionally provide flexible terms, enabling debtors to choose a repayment period that lines up with their monetary scenario.

In addition, installment loans can help improve or develop credit rating scores when repayments are made on time, enhancing future borrowing potential (Installment Loans). This type of funding is especially useful for those looking for to fund significant costs, such as home restorations or clinical costs, as it enables the distribution of expenses gradually, making settlement more manageable

Prospective Downsides and Risks

While installment loans can provide many advantages, they also include possible downsides and risks that borrowers must consider. One significant danger is the capacity for overwhelming financial obligation. If debtors tackle numerous loans or fall short to manage their finances effectively, they might locate themselves in a cycle of financial debt that is hard to run away. In addition, installment loans often have high-interest prices, particularly for those visit their website with less-than-ideal credit rating, which can lead to raised total settlement amounts. Late settlements can cause substantial charges and damages to credit rating, even more making complex financial circumstances. The fixed payment timetable may not accommodate moved here unanticipated financial modifications, making it testing for some customers to maintain up with payments. Finally, some lending institutions may use aggressive collection techniques, adding stress and anxiety to an already perilous monetary circumstance. Comprehending these prospective disadvantages is crucial for anyone considering an installment financing.

Key Considerations Before Applying

Before committing to an installment lending, customers ought to thoroughly evaluate their monetary circumstance and long-term goals. Understanding their income, expenses, and existing debts is important in identifying the expediency of handling extra financial obligations. Borrowers ought to consider the total cost of the car loan, including rate of interest and fees, as these can greatly influence settlement amounts.

Moreover, it is essential to examine the funding terms, such as the payment period and month-to-month installations, to ensure they straighten with one's budget plan. A complete contrast of loan providers can reveal variants in prices and terms, aiding debtors secure one of the most positive choice.

In addition, prospective borrowers must reflect on their credit report, as it affects eligibility and rates of interest. Ultimately, having a clear payment strategy and ensuring a secure income can mitigate dangers connected with skipping on the loan, advertising financial stability in the lengthy run.

Frequently Asked Concerns

Can I Settle an Installation Lending Early Without Penalties?

Lots of lending institutions permit early repayment of installment loans scot-free, however terms differ. Borrowers ought to examine their financing agreements or consult their lenders to verify any type of possible costs connected with very early payoff options.

How Do Installment Finances Influence My Credit Rating?

Installment loans can favorably influence credit history scores by demonstrating liable payment behaviors. Timely payments improve credit report, while missed out on settlements can bring about adverse impacts. Debt application and financing kinds likewise play roles in overall credit rating.

What Takes place if I Miss a Repayment?

The customer may sustain late fees and their credit rating might decrease if a repayment is missed. In addition, loan providers could report the missed out on payment to debt bureaus, possibly affecting future loaning opportunities adversely.

Are There Age or Revenue Requirements for Installment Loans?

Usually, installment loans have minimum age needs, usually 18, and lenders may analyze earnings degrees to verify consumers can pay back. Details criteria differ by lender, so individuals need to talk to their picked banks for information.

Can I Get an Installment Financing With Bad Credit Report?

Yes, people with bad credit score can obtain installment loans. Nevertheless, they might face higher rates of interest or more stringent terms. Lenders commonly assess overall monetary security and settlement ability beyond simply credit rating.

These loans include organized settlement strategies, allowing borrowers to pay back the finance quantity over time with dealt with monthly payments. Personal installment loans offer funds for a broad variety of personal costs, while automobile loans are customized for buying automobiles. Vehicle loans are a preferred kind of installment financing made especially for acquiring lorries. Due to the fact that home equity loans are click to find out more safeguarded by the property, they usually offer reduced passion prices contrasted to unprotected loans. Customers usually pay back the car loan in equal monthly installations over an established period, known as the lending term.